Consistency is one of the cornerstones of successful trading. However, achieving it in the volatile and unpredictable world of financial markets is easier said than done. Emotional swings, market noise, and impulsive decisions often lead traders astray. This is where a well-structured trading plan becomes invaluable.

A trading plan serves as a blueprint that guides your decisions, helping you maintain discipline and develop consistent trading habits. This article explores how having a trading plan fosters consistency and why that consistency is crucial for long-term trading success.

Why Consistency Matters in Trading

1. Improved Decision-Making

Consistent trading reduces emotional decision-making, leading to more rational and objective choices.

2. Reliable Performance Tracking

Following a set plan allows traders to evaluate what’s working and what isn’t.

3. Reduced Stress

Knowing exactly when and how to act creates a sense of control, lowering anxiety.

4. Compound Growth

Over time, small consistent gains can compound into substantial profits.

How a Trading Plan Creates Consistency

1. Establishes Clear Rules for Trading

A trading plan defines specific criteria for entering and exiting trades. When you have clear rules to follow, your trading decisions become predictable and repeatable.

2. Promotes Emotional Discipline

By sticking to a predefined plan, traders are less likely to be swayed by fear, greed, or market noise. This emotional stability fosters consistency in execution.

3. Standardizes Risk Management

A trading plan includes risk management rules, such as position sizing and stop-loss levels. Consistently managing risk helps protect your capital and ensures that no single trade can significantly impact your account.

4. Focuses on Process, Not Outcome

Consistent traders prioritize following their plan over chasing immediate profits. This process-oriented mindset leads to better long-term outcomes.

5. Encourages Routine and Habit Formation

A trading plan helps traders establish routines, such as regular market analysis and journaling. These habits reinforce consistency over time.

Elements of a Consistent Trading Plan

To create consistency, a trading plan should include:

1. Trading Goals

Define clear, achievable objectives.

2. Entry and Exit Criteria

Specify conditions for when to enter and exit trades.

3. Risk Management Rules

Set position sizes, stop-loss levels, and risk-reward ratios.

4. Trading Strategy

Detail the technical or fundamental analysis methods used.

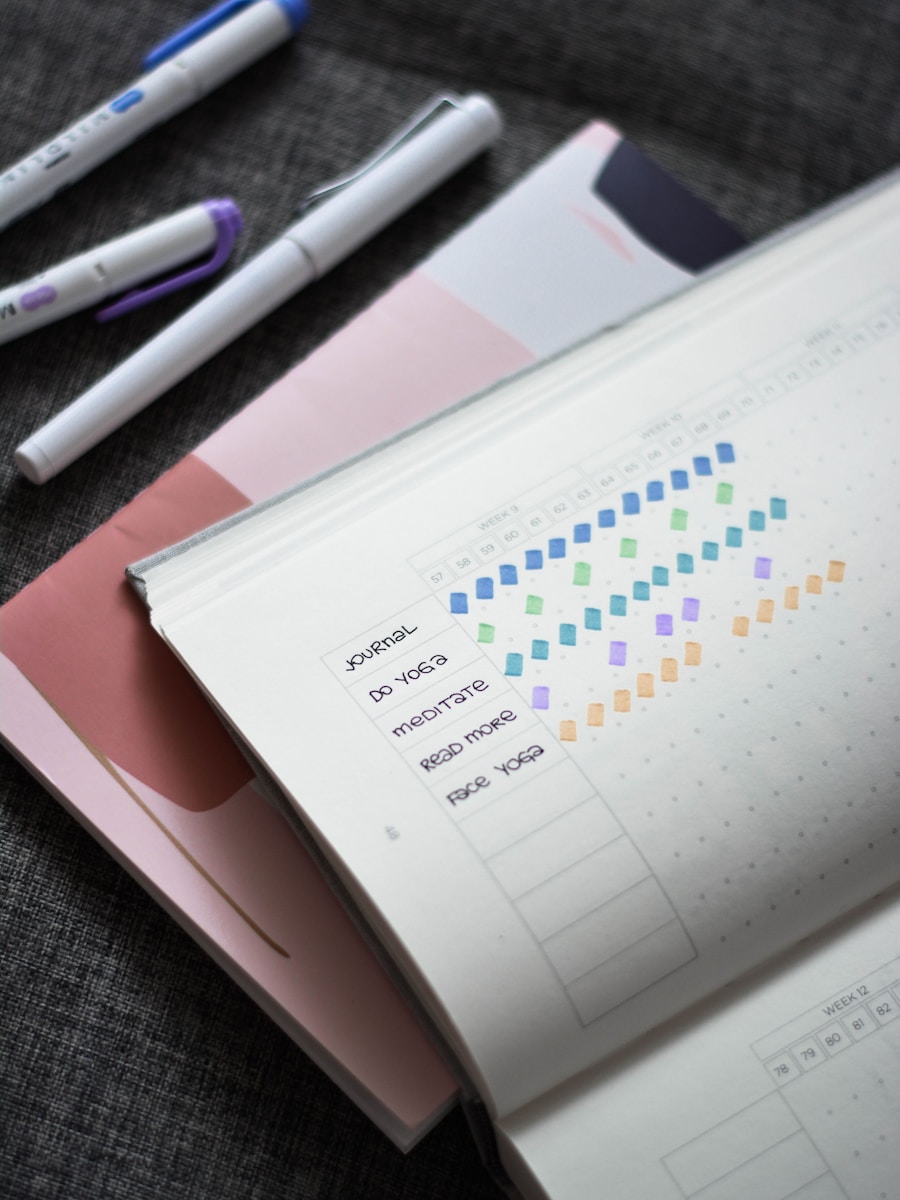

5. Performance Tracking

Maintain a trading journal to analyze and refine your approach.

Tips for Staying Consistent with Your Trading Plan

1. Start Simple

Focus on one or two strategies and refine them before adding complexity.

2. Use a Trading Journal

Document every trade, including your reasoning, emotions, and results. Reviewing your journal helps identify patterns and areas for improvement.

3. Trust the Plan

Avoid deviating from your plan due to market noise or emotional impulses.

4. Set Realistic Expectations

Understand that not every trade will be a winner. Consistency doesn't mean perfection; it means disciplined execution over time.

5. Learn from Mistakes

Analyze trades that didn't follow your plan to understand what went wrong and how to avoid similar mistakes in the future.

6. Adapt When Necessary

Markets evolve, and your trading plan should too. Periodically review and adjust your plan to stay aligned with current market conditions.

Psychological Benefits of Consistency

1. Increased Confidence

Following a plan reinforces positive trading behaviors and builds self-assurance.

2. Reduced Stress

Knowing you have a structured approach lowers the anxiety associated with trading.

3. Enhanced Discipline

Consistency strengthens your ability to stick to rules and resist impulsive decisions.

4. Better Long-Term Results

Over time, consistent execution leads to more stable and profitable trading performance.

Conclusion

Creating consistency in trading is essential for navigating the unpredictable nature of financial markets. A well-structured trading plan provides the framework needed to maintain discipline, reduce emotional decision-making, and foster long-term success.

Remember, consistency doesn’t mean avoiding losses altogether — it means approaching every trade with a clear, disciplined mindset and a plan you trust. By prioritizing consistency, traders can build the foundation for sustainable and profitable trading.