In trading, success isn’t solely determined by market knowledge, technical analysis, or even capital size. A trader's mindset plays a crucial role, and setting clear, realistic trading goals is one of the most powerful psychological tools for staying focused and motivated. However, without thoughtful planning, trading goals can quickly become a source of stress or lead to unrealistic expectations.

This article explores the importance of trading goals, how they shape your psychology, and practical strategies for setting and achieving them.

Why Trading Goals Matter

1. Provide Focus and Clarity

Goals help traders define their purpose and create a clear roadmap for success.

2. Enhance Discipline

Having goals encourages traders to stay committed to a structured trading approach.

3. Measure Progress

Goals make it easier to track performance and identify areas for improvement.

4. Boost Motivation

Achieving even small milestones can build confidence and keep traders motivated during challenging periods.

Types of Trading Goals

1. Performance Goals

- Example: "Achieve a 5% monthly return over the next six months."

These goals focus on measurable trading results.

2. Process Goals

- Example: "Stick to my trading plan without deviation for 30 consecutive trades."

Process goals emphasize following good trading practices rather than specific profit outcomes.

3. Learning Goals

- Example: "Study one new technical indicator each month and backtest it."

Learning goals focus on improving skills and market knowledge.

4. Risk Management Goals

- Example: "Never risk more than 2% of my account on a single trade."

These goals help traders maintain discipline in managing losses.

The Psychology Behind Trading Goals

1. Building Confidence Through Achievements

Meeting well-structured goals reinforces a trader's belief in their abilities, fostering a positive mindset even during market downturns.

2. Reducing Emotional Decision-Making

Clear goals keep traders grounded, reducing the likelihood of impulsive trades driven by greed or fear.

3. Promoting a Growth Mindset

Focusing on learning and process-based goals helps traders adopt a mindset of continuous improvement, crucial for long-term success.

4. Managing Expectations

Realistic goals prevent traders from chasing unrealistic returns, which can lead to frustration and reckless behavior.

How to Set Effective Trading Goals

1. Make Them SMART

Goals should be:

- Specific: Clearly define what you want to achieve.

- Measurable: Quantify your goal to track progress.

- Achievable: Set goals that are realistic given your experience and resources.

- Relevant: Ensure your goals align with your broader trading strategy.

- Time-Bound: Set deadlines for achieving your goals.

2. Focus on Process Over Profit

Instead of solely aiming for a profit target, prioritize goals that reinforce disciplined trading behavior.

3. Break Goals into Milestones

Divide long-term goals into smaller, achievable steps to maintain momentum.

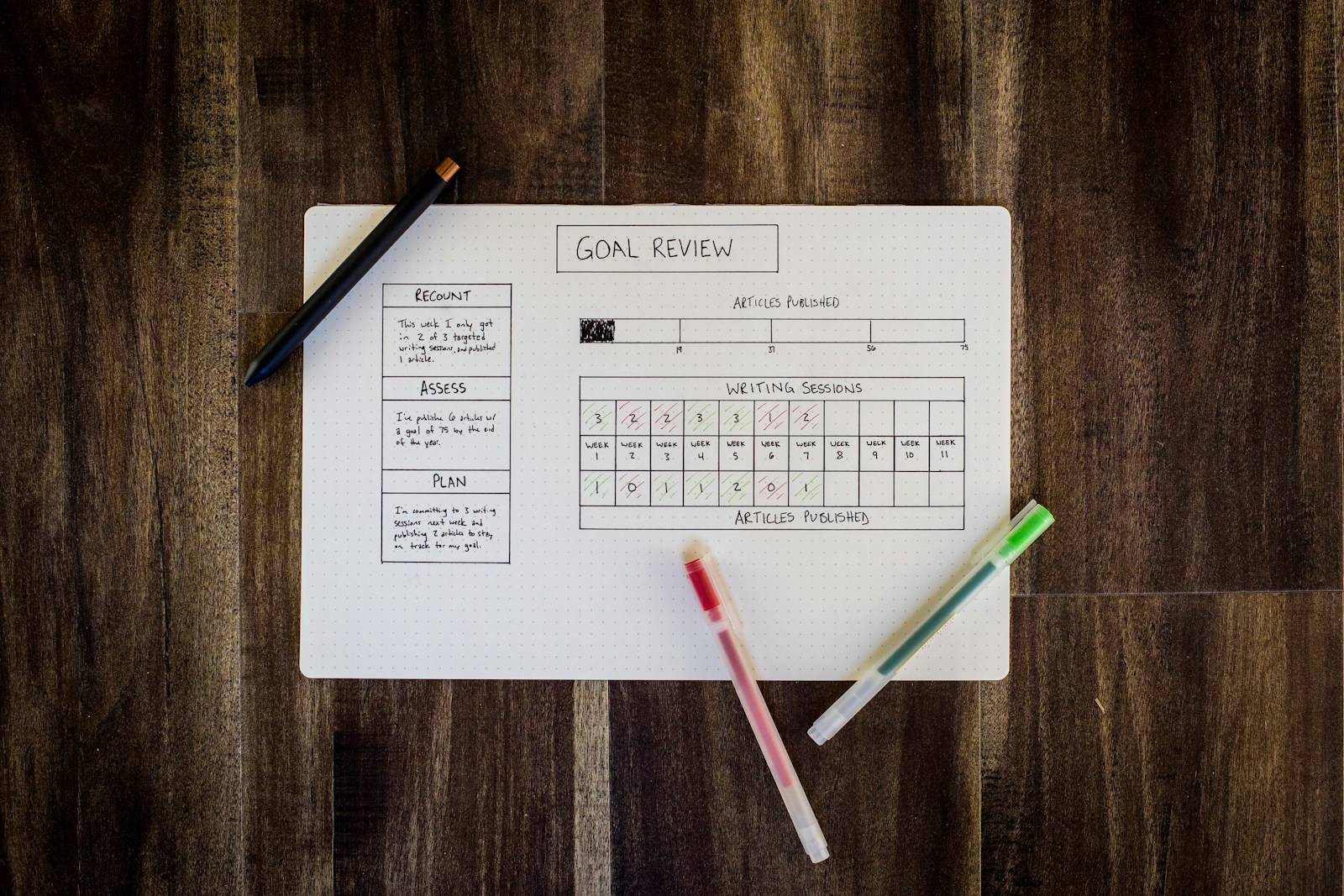

4. Write Them Down

Documenting your goals creates accountability and serves as a constant reminder of your objectives.

5. Review and Adjust Regularly

Markets change, and so should your goals. Periodically assess your progress and adjust goals as needed.

Common Pitfalls to Avoid

1. Setting Unrealistic Goals

Avoid overly ambitious targets that can lead to frustration and impulsive trading.

2. Focusing Only on Profits

Profit-based goals can encourage risky behavior; balance them with process-oriented goals.

3. Neglecting Risk Management

Goals that ignore risk management often lead to unsustainable trading practices.

4. Failing to Track Progress

Without tracking, it's impossible to know whether you're moving in the right direction.

The Psychological Benefits of Achieving Trading Goals

1. Boosted Confidence

Meeting goals reinforces positive trading habits and builds self-assurance.

2. Reduced Stress

Clear goals create structure, reducing the anxiety associated with market uncertainty.

3. Increased Motivation

Achievements, no matter how small, keep traders motivated.

4. Enhanced Focus

Goals help traders concentrate on their strategy rather than market distractions.

Conclusion

Setting and achieving trading goals is a vital part of developing a disciplined and resilient trading mindset. By focusing on clear, achievable objectives and balancing profit-based goals with process and learning goals, traders can foster long-term growth and success.

Remember, trading is a journey, not a race. With the right goals and a commitment to continuous improvement, you can navigate the markets with confidence and discipline.